The Standard Bank First Time Home Buyers' campaign will run for the period 1 January 2026 to 31 December 2026, and Standard Bank is offering a 50% discount on the... read more →

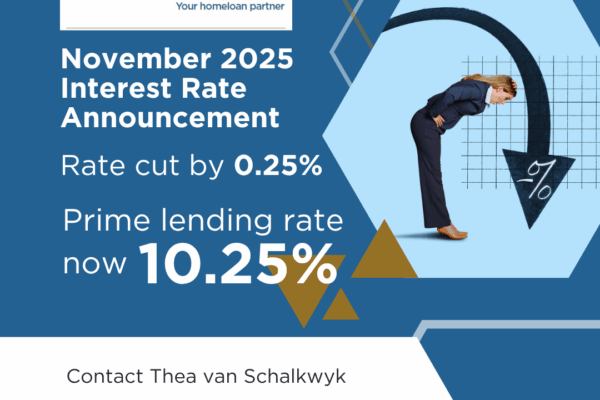

The South African Reserve Bank has voted to keep the interest rates as is with the repo rate at 6.75% and the prime lending rate at 10.25%. To read more,... read more →

The announcement was made on 20 July 2023 that, due to a lower inflation rate, the prime lending rate will remain at 11.75% which puts the recent interest rate hikes... read more →

To watch the Reserve Bank announcement, please click here.

"South Africa appears to be reaching the end of its current interest rate cycle, but homeowners may need to brace for one more hike next week. Some experts predict the... read more →

As expected, the interest rate has been increased once again. Just a reminder that we have included easy to follow instructions on how to fix your interest rate . If... read more →

"South Africa cannot afford to be left behind when it comes to rate hikes, otherwise the rand and local assets like bonds will lose their appeal to foreign investors, who... read more →

By hiking interest rates, the Reserve Bank wants to cool down inflation by suppressing demand in the economy. This is how the new prime lending rate of 9% will impact... read more →

The latest edition of the FNB Residential Property Barometer's key themes include: • Market volumes remain relatively supported, but softening. Sentiment and forward-looking activity indicators suggest more weakness ahead. However,... read more →